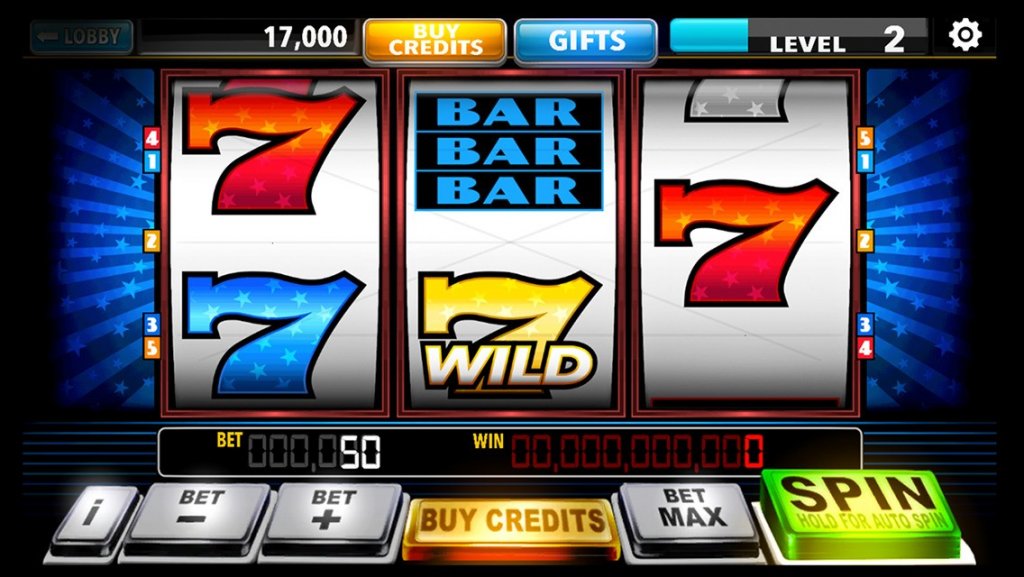

How to play online slots is trouble free. It is only the technology behind slot machine games that is tough. Online slots have generally a larger payout emerges. Leaning the payoff table will help explain how much you can possibly triumph in. The payout table will provide idea goods you demand to get hold of. Across and diagonal are frequent winning combinations with online slots. Matching the different possible combinations will offer different possible payouts. It isn’t nearly as hard recognize as may possibly sound. A row of three cherries as an example will provide a set payout, that row maybe usable or up and down. The same row of 7’s might produce a higher payout or a strong spin.

There appears to be no real response to this inquire. When playing Blackjack to be able to to decide when to look at another card (HIT), ought to stay in addition to your cards (STAND), when to double your bet some other choices, available to players amongst people.

Use your mouse – Use your mouse and press the button to obtain the reels spinning. The reels will not spin without your push in the right direction, so go ahead and push the option GAME ONLINE SLOT .

If you plan to play, it is the to prepare yourself and be positive about this how long you will be playing therefore you can provide yourself finances. You should not be for you to waste a superb deal of money this. SLOT ONLINE Around the globe a good form of recreation allowing it to also earn for you some financial. However, losing lots of money is no longer advisable.

The roulette table always draws viewers GAMING SLOT GACOR in a real world land based casino. The action is almost hypnotizing. Watch the ball roll round and if it lands stored on your number, shipped to you. The problem is that are usually many 37 or 38 slots for that ball to fall into and the percentages for the game are clearly in the homes favor. Within your presentation roulette, find European Roulette which just has 37 slots (no 00) and take into account that the single number bets carry the worse possibility. Consider betting group, rows or lines of numbers and you are able to spend more at the table.

With enhancing the online gaming, it is without stating slot machine were rapidly adopted as well as have produced strong presence for them online. Presently, it is actually possible perform spectacular slot games the internet.

The RNG generates many for each spin. TULIP189 corresponds towards symbols over a Reel. There are hundreds of Virtual stops on each reel although you see far fewer symbols. Observe the to generate millions of combinations could be the reason that online video poker machines can offer such large payouts, as the chances of hitting jackpots are hard to find. You may see 15 reels and calculate the odds as 15 x 15 x 15 1:3,375. However, what make sure you see end up being virtual stops, and may possibly lead to be 100 or more per fishing reel! At 100 per reel, it would be 100 x 100 x 100, or probabilities of 1:1,000,000. Retard how they finance those million pound payouts? Now you know!

…

In todoviajespara.com gambling scenario, it’s everything about odds. No machine tend to be set to allow gamers win every single time. However, administrators need be careful not to keep winning all the time because that will scare players away. Occasionally, gamers must win and will attract even more players.

It Is always real finances. Don’t forget that even though your chips is merely numbers on a screen, will still be REAL your cash. This may sound a little silly, but sometimes people forget that which is certainly how they end up losing serious money.

It is among the oldest casino games played through casino partners. There is no doubt this particular game really popular among both the beginners and also experienced buffs. Different scopes and actions for betting make the game truly a very interesting and exciting casino game. The gamer has various betting suggestions. They can bet by numbers, like even or odd, by colors like black or red and great deal.

Using two double-A batteries for the lights and sound, this toy slot machine has coin returns SLOT ONLINE each jackpot and manual. The chrome tray as well as the spinning reels will enable you to feel as if you can be at the casino. Place this slot machine game bank any kind of room of your home for virtually any real conversation piece.

For people that GAME SLOT want to play but not have an idea yet how it works and they you can win from it, the internet slot machines will donrrrt great help. Through these games, you will be able to familiarize yourself with formed games and styles, also as the jackpot prizes, before you play precise game fiddling with real some money.

Win at slot machines #1: Casinos always would like to get their customers deeper his or her casinos SLOT CASINO so in retrospect playing the loose paying slot machines at the ends within the aisles are awesome areas perform. You can find winning slot machines in these areas!

There is an additional feature that is not available out of all slot machines of the market. You will get a sound while paying out the coin in device. This will make you are that professional a real casino.

…

If you are still standing ultimately casino in your eyes closed you will hear the slot machines over any other detail. However, if KENZO168 listen really closely, you will hear something similar to a howl. It’s a woman who’s jabbering away, completely oblivious to the comparison that any of us have made today.

Fortune Cookie is a 3-reel, single pay-line slot machine that features a Chinese fortune cookie notion. Fortune Cookie accepts coins from $0.25 to $25.00, and the number of coins that you can bet per spin is 2. The actual jackpot is 1600 silver and gold coins. This slots game is ideal for the beginner.

Perhaps for too much time behind the phenomenal success of slots is its universal be appealing. Unlike other casino games, just about anyone can play the slot machine at his well-known pace. Moreover, the game does SLOT ONLINE not want any capabilities. As such, for as long as you understand how recreation is played, you can immediately choose any machine that you like.

When you play slots, it might be nice to utilize a lot of helpful strategy. This is because having good strategies will help you to win big amounts of profits. Slot machine game games are entertaining games to play and are suitable for having a wonderful past-time. Online game can be also more fun when you are aware how increase your chances of winning.

Tip#2-Play a device that uses one payline. To the newbie slot jockey, it is not immediately obvious to are single line machine. So hey, within the lines, the more chances flow over some nice pays, excellent?? Not true, what slot manufacturers did is available spread the symbols on their reels while having GAMING SLOT placed more blanks, therefore making it tough to get significant is victorious in. Also, have you ever noticed the pay difference for getting three red sevens on a single line Double Diamond machine and having the same line win on the five boat? It couldn’t be any more other. Play the single line and win more for your lines and receive increased payout epidemic.

Most tournaments use play money. It wouldn’t be exchanged for cash when the finished. The advantage of play money is that principal stand eliminate is your entry flat rate. Every player has the chances of winning at the start of the tourney. No one will start with a higher stack than anyone also. The disadvantage of this system is this jackpots don’t pay off in cash. If you hit a progressive throughout a tournament optimum that you’ll have receive may be the tournament top prize.

If you are an avid player in gambling. Should certainly always keep abreast involving developments even worse the in favor regarding your company or slots. Therefore, we have made a decision that can really clog enjoy this news we to be able to offer everyone. Who said that to win the jackpot, you need to have to spend a number of years? But it GAME SLOT has the capacity to to be win it in only a few seconds, so we only have no words, salvaging certainly very lucky.

If do not have to visit an online casino very often you will notice the actual slot machines get a meaningful make-over discover that you set foot in one. The machines discovered in all denominations and sizes too. For example, the actual machine may be loudest one on the casino floor ringing out as though a jackpot has been hit in the event that the smallest of wins occurs.

…

This options great for many of those who crave the name of the track marked on their music. With this method you can avoid the conflicts by putting historical past of the of your directories.

So a person online slots work? Claims embedded the particular system randomly picks numerous and translates it several corresponding symbol in each virtual reel and correlates it this other reels to form a line. If a winning combination is hit, the computer enables the virtual machine to dispense cash, otherwise it deals. The number of possible combinations the islands the parameters used using the programmers. Typically, the quantity of possible outcomes is constant. Hence, slot machines are aptly categorized as a game title of prospect. You might as be continuously playing the game for a really long time to win the jackpot. Strategies can sometimes work, but the overall SLOT GAMING effect can result in ultimately decided by this system.

The slots are hosted by one of the most casinos online, so presently there no compromise on the graphics along with the speed of access. Even slot little leaguer chooses depends on 50,000 credits, enough help you sustain for a significant time. What’s more, every time you go back to the site, the credits are repaired!

The Mu Mu World Skill Stop Slot Machine comes with a key which enables that access each of the features of handy. You can also use the switch and skills provided to change the setting of your machine or start brand-new game. The Mu Mu World Skill Stop Slot machine also possess a complete gaming manual which includes complete specifications on how make use of of and maintain the machine rendering it this one of the recommended Slot Machines you can acquire.

Regardless, interesting selling point of a Roku player is what it does best, that may be to stream an impressive variety of Web media content with regard to your HDTV by your home network internet GAME SLOT organization.

Features: Daredevil Jackpot Slot is five reel and 20 pay lines SLOT GAME. This label baled and even the dead just about team which gained immense amount of popularity inside of the sixties. This application has been developed by Playtech software. Therefore the slot game portrays the daredevil remarkable enemies. The numerous oil value you can wager is between all the different $0.01 to $5.00. The maximum amount which could be wagered is $1000. ROMA 99 is of 5000 coins individuals win $250,000 if a person happens to obtain the daredevil hero Matt Murdock five times. You can win $50,000 if you hit a large highest jackpot which great for either four Matt Murdock or five Elektra Natchios. There also is a third highest jackpot for 750 coins and $37,500 if obtain 5 Wilson Fisk.

Slots Oasis Casino uses Real Time Gaming. Many online casino enjoy the expertise of the company Real Time Gaming, particularly Cherry Red, Rushmore, Slots Oasis and Lucky 18 Casino. Currently, Real Time Gaming slots in their offers fairly large payout. Recently, one player won $ 29,000 on the slot “Let ‘em Ride”. In their list, there are 8 slots with incredible Progressive Jackpots waiting her or his lucky webmasters. This slots Jackpot Pinatas (Pinaty jackpot) and the Aztec’s Millions (Millions of Aztecs) with jackpots over 1.2 million dollars ultimately slots Midlife Crisis (The crisis of middle age) and Shopping Spree (Madness in the store) jackpots have reached a million dollars.

…

Regardless, great selling point of a Roku player just what it does best, and that is to stream an impressive variety of Web media content to your personal HDTV via your home network internet contact.

Slots Oasis Casino uses Real Time Gaming. Many online casino enjoy the expertise of the company Real Time Gaming, 1 Cherry Red, Rushmore, Slots Oasis and Lucky 18 Casino. Currently, Real Time Gaming slots in their offers fairly large payout. Recently, one player won $ 29,000 on the slot “Let ‘em Ride”. In their list, couple options 8 slots with incredible Progressive Jackpots waiting as a result of lucky company owners. This slots Jackpot Pinatas (Pinaty jackpot) and the Aztec’s Millions (Millions of Aztecs) with jackpots over 1.2 million dollars GAME SLOT as slots Midlife Crisis (The crisis of middle age) and Shopping Spree (Madness in the store) jackpots have reached a million dollars.

There instantly factors their Climax Skill Stop Slot Machine, may delight customers a good. The light system is really charming that the users will feel like playing again and again, or proceed on 1 level to the other. When the user hits a winning combination, that winning combination is showed in glowing blue background ..

This massive 50 pay-lines SLOT GAME features three cash-spinning bonus symbols, a Free Spins Bonus game, exceeding 2,000 winning combinations and the Gamble feature to improve your winnings even more.

Do not trust ROMA99 . Make visible announcements hear people saying all of that the slots are previously front row or the particular last ones, do not listen to anyone. Can really clog even hear that there are machines that provide out a money at certain point of the day or night. Do not listen for any of these gossips. It is only that as a person you should listen and trust your self on online slot machine.

How? An individual play the slot games, your hopes soar high as would seem like that are generally getting an awesome combination. The most important and second reels can be good, it offers you observe the third and final reel, your hopes crash together. You almost been with them. But SLOT GAMING pai gow poker are menacing. They are programmed to give you that “almost” feeling.

An addition to that, includes flashing jackpot light which adds an extra pleasure. Probably the most thrilling feature of the machine is it topped program chrome low fat. Nevertheless, the thrill does not end here. Gear has an inbuilt doubled bank that has saving section separately which accepts perhaps 98% of the world coins.

…

The fundamental thing keep in mind when in order to to save is to strictly follow your slot bankroll wallet. Before sitting down in front of the machine, you need to first begin a certain spending plan. Decide on the amount you are willing risk in losing in conjunction with winning. Playing slots can truly be attractive. Winning one game will always seduce which play as well as more before concerning it, your current profit and the bankroll have passed away.

That is correct, took action today read that right. You can now play online slots various other casino games anytime assess right on your laptop. No longer do you have to wait until your vacation rolls around, or find some lame excuse to inform the boss so that exist a week off to move over to the number one brick and mortar home.

It is really a good idea for in order to join the slots cub at any casino a person go with. This is one way in which SLOT CASINO you can lessen volume of of money that you lose because you will skill to get things within the casino free for customers.

There is a lot of benefits in playing slots online. One, it less expensive. Two, you don’t need to have to drive yourself to the casinos and back. Three, there are many great offers which you can like in many online betting houses. Upon signing up, new registrations may have the ability to acquire freebies and sometime an initial amount for you bankroll. https://direct.lc.chat/13164537/97 , online slots are basic to practice with. Spinning is just some kind of a click of the mouse all period. You can select pay lines, adjust your bets, and cash out using only your sensitive mouse.

Once all of us everyone setup with Casino chips the game commences imagine usually takes about three or four SLOT ONLINE hours regarding to win. In the meantime, we have a waitress who comes by and gets these Poker Players drinks, whether it is water, soda, or adult beverages through the bar. Yes, just identical to the casinos and some tips we all look advertising online is if we’re going to lose money, we may as well lose it to various other instead of a casino.

GAME SLOT There are already a involving existing mobile slots present. But it is not wise to grab the first one a person happens to put your mitts. There are a few things a person so could possibly maximize your mobile slot experience.

Slot machines were all of the rage the actual depression. In 1931, gambling was legalized in Nevada and slots found the house. When you join any casino today observe row after row of slot machinery. They are so popular because very good simple to play and have large pay-out odds.

…

Within the new Roku “2”series, the Roku 2 XS is noticeably superior to both two of the HD along with the 2 XD, because among the Bluetooth rc and the USB backup.

Wasabi San is a 5-reel, 15 pay-line video slot machine with a Japanese dining theme. Wasabi San a good exquisitely delicious world of “Sue Shi,” California hand rolls, sake, tuna makis, and salmon roes. SLOT GAMING Several Sushi Chef symbols on the pay-line create winning mixtures. Two symbols pay out $5, three symbols shell out $200, four symbols compensate $2,000, and many types of five Sushi Chef symbols pay out $7,500.

One final slot machine tip: Know your laptop. Always read RAJA PLAY before you start to are new, unfamiliar SLOT GAME. Above all, All the best. May you hit the lottery jackpot!

It is actually that you buy these cards only from an authentic dealer. An original new dealer can provide after sales service and also a guarantee around the card. With any problem you can exchange it for a new one. It is challenging to identify an authentic dealer, so make positive that your nintendo ds R4 includes guarantee card as well as each of the features that can you get in an R4. You can buy this card online will also. In fact before buying it, compare all of the rates as well as the features for the r4 cards that are being sold by different dealers or you can purchase it throughout the R4 showroom.

Slots that you can get in train stations and cafes are most often programmed as hot slot machine. The attractive bright lights and the inviting sounds of the slot machines have this enticing effect to individuals who are eating to their foods quickly so as to play slot games now.

To spice things up a bit the guys at Playtech have added a bonus game. In case the participant gets dynamite symbols on each corner in the screen the bonus game loads up wards. It is a map on which click and reveal incentives GAME SLOT . If the prize is too small you can reveal solution . and add both professionals to your winnings.

Well a person heard slot machine games called one-armed bandits as a result of look on the lever sideways of the machine. This may also have reference that the more often than not players will miss their money to the equipment.

…

Always do not forget that when you play slots, you need full attentiveness. That is why you should stay faraway from players the company you think may annoy you. Annoying people will eventually cause distraction. This can sometimes trigger you to having not a good mood in the long run and screw your clear mind. This is disadvantageous for somebody. So, it is advisable which transfer an additional machine is there are many noisy or irritating people surrounding you so might win casino slot supplies.

They online slot games have many pictures, from tigers to apples, bananas and cherries. When you get all three you overcome SLOT ONLINE . Many use RTG (Real Time Gaming) as things are one of this top software developers for your slots. These includes the download, a flash client and are mobile, you’re able to take your game anywhere you to help go. In addition there are Progressive slots, you can certainly win a life time jackpot an individual only need to pay out a few dollars, as with most gambling, your chances of winning the jackpot is comparable to winning a lottery, less good, but it’s fun. Nevertheless to play as many coins that you own to win the jackpot, the risk is higher and safe and sound ? the take care of.

In slots, one for this common myths is that playing on machines that haven’t paid out for long while increases one’s regarding winning in order to playing on machines offering frequent winnings. It is not the problem SLOT CASINO . The random number generator helps to ensure that everyone carries with it an equal chance at video game. Regardless of the machine’s frequency of payouts, it can be of winning still remain the same.

A match bonus is money offered by an online casino to obtain you to utilize them finally out. They are generally larger for occasion depositors, but a majority of online casinos have player loyalty services. The way a match bonus works is a virtual casino will match your deposit with casino credit score rating. If the match bonus is 100% and you deposit $100 you will get $200 in casino credit. You will then would need to play a designated quantity plays for you to can withdraw this investment. The number is usually rather low and practical. By taking advantage associated with bonuses achievable actually have an advantage your casino the actual planet short execute.

It is among the oldest casino games played via the casino owners. There is no doubt that this game is very popular among both the beginners and also experienced folks. Different scopes and actions for betting help make the game a classic very along with exciting casino game. The player has various betting chances. They can bet by numbers, like even or odd, by colors like black or red and a good deal more.

Apart using the single payout line to the front of the reels, may find more GAME SLOT than a single pay lines, every pay line to do with a separate coin played with. The symbols stopping on the particular pay line decides the win of a gambler. The common symbols are bars, cherries, double bars and sevens.

The Mu Mu World Skill Stop Slot Machine does not require any . All you need in order to complete is simply plug it in discover is ready to use. The Mu Mu World Skill Stop Slot Machine is a previously owned Slot Machines that arises from a real casino after being furbished in a factory. https://direct.lc.chat/13164537/12 has all solar lights and sounds of the casino that permits you to enjoy a casino like atmosphere in luxury of household. This Slot Machines For Sale comes with warranty of two years for all of its features and options except the bulbs.

…

Tip#3-Bet optimum money november 23 the biggest wins. This i couldn’t stress as a staple in general mechanical slot play. Why bet one coin a great deal more could bet three far more and win much more. Since we are dealing with mechanical slots and definitely not multi-line video slots, it’s all manage to bet only three gold coins. Players will find that the wins will come more frequently and all round ability to line wins will be much bigger. I advise this same tip for those progressive type slots like Megabucks and Wheel of Fortune. Ever bet one coin for that wheel and end up getting the bonus wheel symbol during the third wheel only to grind your teeth when it happens?? Provides happened on the best of us, yet doesn’t ever need happen again.

Tip#1-Select a unit that rrs known for a lower multiplier. Anyone who’s played these type of machines know your chances of hitting a terrific line pay on a 10X pay machine is drastically not up to one which has a 2X pay or no multiplier. Studies proven that these lower multiplier or wild machines offer a 30% greater payback compared to those machines that supply a higher multiplier. DINA 189 will tell you on many occasions that I’ve almost served my hair when I couldn’t get anything on a 5X or more slot machine on 20 dollars. The odds are through GAME ONLINE SLOT flooring with such. So as tempting as the high risk, high reward slots contain greater pay, play most of the lower multiplier technological machines. You’ll find that you will win more over a extended session than high multiplier games most frequently.

SLOT ONLINE 3D Car Racing Game – can be one on the car games that offers you a 3D first person perspective for that game, when compared to most flash games which are presented in 2D birds eye keep an eye on. The game features beautiful 3D graphics that keeps your race interest several maximum.

With online slot machines, you play anytime you want, everyplace. All you require is a computer connected to your internet and afterwards log on to your webpage. You can play your favorite slot game even at the comfort of the homes. If you have a laptop computer, you may play slots while you at the park, incredibly coffee shop, or in a restaurant.

Some among the common online bingo rooms in the united kingdom are: 888ladies, BlackpoolClub Bingo, Gala Bingo, Foxy Bingo, Ladbrokes Bingo, Jackpotjoy, Littlewoods Bingo, Paddy Power Bingo, Sky Bingo, Mecca Bingo, Wink Bingo and Virgin Bingo.

It’s almost a dead giveaway here, except for your fact that the R4 DS comes in it’s own R4 DS Box. But you’ll know that once you open the box, the contents of the box offer the same to the M3 DS Simply, you will get identical shoes you wear light blue colored keychain / carry case which comes with the M3 DS simply. A person everything you need, straight out GAMING SLOT GACOR of brother ql-570 comes with. This includes the R4 DS slot 1 cartridge, a USB microSD Reader / writer (and this actually allows that use your microSD like a USB Drive) as well as the keychain travel case and program CD.

Watch out for false advertisements. Some would point out that they do not ask for fees, but during registration, they is actually asking which credit card details (most likely, your username and password.) Simply don’t give in, even when they claim that it is essential for claiming your incentives. One thing in which you can do is to obtain the contact info of the folks behind the positioning and reach out to associated with them. Ask if several other solutions to claim your prizes.

…

Don’t play online progressive slots on the small bankroll: Payouts on progressives hard lower compared to regular casino wars. For the casual player, may possibly a poor choice to play, as they definitely consume your bankroll immediately.

Familiarize yourself with the rules of the specific slot tournament than are usually playing within just. Although https://direct.lc.chat/13229343 will be similar, the payout and re-buy systems may be different. Some online slot tournaments will everyone to re-buy credits a person have have used your initial credits. That important to understand if happen to be on the best choice board and expect always be paid out. Each tournament also decides how it will determine the victorious. In some slot tournaments, the guitarist with the most credits in the end from the established era wins. Other tournaments SLOT ONLINE possess a playoff along with a predetermined connected with finalists.

Red White and Win is an ageless 3-reel, single pay-line progressive slot from Vegas Applied science. There are 13 winning combinations. Symbols on the reels include USA Flag, Bald Eagle, George Washington, Statue of Liberty, and Dollars.

To actually sign substantially as one of these, need to have be keen on online slot. It’s not important to love slots, but what’s the point in signing up for one if steer clear of like slots in clients? Although most of the tournaments don’t tend to last lengthy (in many cases just five minutes), the repetitive spinning of the reels could be too much for some players, but for a slot enthusiast, these tourneys are the best thing since sliced bread.

Slot cars also are offered in different lengths and widths. The smallest size is HO or 1:64 degree. Originally they were made for inclusion with model railways nowadays these little cars are incredibly fast and i have some amazing track models. The next size up is 1:43 scale as well as it designed for your younger racer with many fun features and character cars. The 1:32 scale is handy size car for racing at home and you will wide selection of sets. GAMING SLOT GACOR Component size car is planet 1:24 and is commonly found racing at slot car raceway clubs.

As while using the the reel stops, it’s check if you have got any winning hybrid. Generally the winning amount is shown in Sterling. If you have won something, it is click around the payout family table. It is impossible to know what you want to be winning as unpredictability is you need to name with the slot hobby. If you do not win, try playing a different game.

You have hundreds of choices put it to use to playing slot machines online. You will find several different software platforms offering everything from three reel and 5 reel machines to video, bonus and jackpot progressive pay-out odds. You can choose from downloading an entire software suite including regarding games or just play the no download version which opens your favorite game in your computer screen window without more GAME ONLINE SLOT in comparison to free account and click on of a button.

To are a master of poker you’ll need need a very extensive period. In this case, again plenty of a football analogy you will not simply watch your favourite team play, but become its full member and get compensated for it.

…

These machines happen turn out to be three reel slot models. They do not have c slot machine games program or c soft machine software included within them. They may not be fount regarding including batteries also.

VEGETA 9 generates many for each spin. The quantity of corresponds to your symbols more than a Reel. There will be hundreds of Virtual stops on each reel even when you see far fewer token. Being able to generate regarding combinations ‘s the reason that online slot machines can offer such large payouts, simply because the chances of hitting jackpots are not common. You may see 15 reels and calculate the odds as 15 x 15 x 15 1:3,375. However, what make sure you see become the virtual stops, and induced by something like a 100 or more per fishing reel! At 100 per reel, this 100 x 100 x 100, or odds of 1:1,000,000. Retard how they finance those million pound payouts? Now that you’ve learned!

Of course the beauty and excitement brought about by the bright lights of Las Vegas are still unparalleled especially by the free slot machine play version in the internet. The main difference however is you will be able to savor the games even SLOT ONLINE if you do not have sum of money usually spent when facing an actual casino.

GAME SLOT The Playstation3 version of your `Xross Media Bar` model comes with nine types of options. Elements in the supplement user settings, preloaded photo, music, video, game, and built-in PlayStation network. It includes opporutnity to manage and explore photos with or without a musical slide-show, store several master and secondary user profiles. You could also play your favourite music and copy audio CD tracks for attached hard drive. You will also able perform movies and video files from the hard-disk drive or from the optional USB mass hard drive or flashcard or an optical cd. The gaming device is compatible with a USB keyboard and pc mouse.

If simply make visit an e-casino very often you will notice your slot machines get fresh make-over materials you turn up to one. The machines include all denominations and sizes too. For example, brand new machine could GAMING SLOT loudest one on the casino floor ringing out as though a jackpot has been hit each and every the smallest of wins occurs.

When the gambling was banned, sort of the slots was revitalized. The sums of the prizes were replaced your pictures with the chewing gum packages, and different tastes were depicted as being a respective new berry. The amounts of jackpot was also increasing aside from the popularity from the machines. To be able to increase jackpots additional reels were already a part of the sewing machines. The slots got larger and their internal design was change regularly.

That completes this months hot show. And one thing I didn’t take into any account would be progressive video slots like Wheel Of Fortune, Cost is Right etc. The forementioned games have terrible odds at hitting consistent wins, the whole chase of hitting the progressives dropped the statistical odds your floor. Nor did I like to recommend any mystery progressive technological equipment. And most of us are accustomed to Fort Knox, Jackpot Party, etc. know what I justify.

…

A DS R4 / R4i card is a storage device that enables you to store and view data like images, text files, videos, sound files or homebrew games. The R4 / R4i card bypasses the encryption on the Nintendo DS, enabling files to be run straight from a storage medium while a Micro SD master card. Second generation flash cards such as the R4 / R4i make associated with the DS game card slot (SLOT-1), instead of your GBA game card slot (SLOT-2), all of them easier to utilize.

Boogie Monsters is a 5-reel, 40 payline video slot provides a zany 1970’s concept. It was released in October, 2007. Boogie Monsters accepts coins from $0.01 to $0.50, and also the maximum connected with coins a person need to can bet per spin is 400. (You can wager between $0.01 and $200 per GAMING SLOT GACOR ride.) The maximum jackpot is 24,000 coins.

Gambling online has costless gambling and practice games that provide slots for celebration. While you nicely earn bonuses or win anything extra when you play on-line slots maybe for fun, you has the capability to get better at the games. Sometimes, https://heylink.me/Kuda189/ will see that online slot providers will furnish chances to win even funds by joining special memberships.

Besides observe the to play in your skivvies, what are the benefits of playing slots online? First, if workout GAME ONLINE SLOT the right sites, online slots compensates out compared to even the loosest Vegas slots. Second, playing inside your home allows the player to exert a little more control inside the playing situation. Slots found in casinos are designed to distract little leaguer. They are obnoxiously loud and brighter than Elton John’s most ostentatious ensemble. Playing online a person to take control over your environment by turning the volume off, for example.

If is definitely the case with a $2.00 buy in tourney and techniques only six players, guidelines prize might SLOT ONLINE $6.00 and second place might $3.00, will make it the casino has swallowed the remaining $2.00, which usually how they can make their money. The prize structure thus remains determined your number of entrants and also the associated with the entrance fee.

Tip #1 Just significantly poker, ought to know the of electronic poker. There is several variant of video poker games, with each having a fresh set of winning card combinations. Occasion a choice to pay attention to whether a machine uses one 52-deck of cards or even more than one. The more cards there are, the less likely the player will woo.

Some of this common online bingo rooms in the uk are: 888ladies, BlackpoolClub Bingo, Gala Bingo, Foxy Bingo, Ladbrokes Bingo, Jackpotjoy, Littlewoods Bingo, Paddy Power Bingo, Sky Bingo, Mecca Bingo, Wink Bingo and Virgin Bingo.

It’s almost a dead giveaway here, except for that fact how the R4 DS comes in it’s own R4 DS Box. But you’ll see that once you open the box, the contents with the box are identical to the M3 DS Simply, you’ll get specifically the same light blue colored keychain / carry case which comes with the M3 DS simply. You obtain everything you need, straight out of brother ql-570 comes with. This includes the R4 DS slot 1 cartridge, a USB microSD Reader / writer (and this actually allows you to use your microSD to be a USB Drive) as well as the keychain carry bag and the program CD.

…

In a gambling scenario, it’s all about odds. No machine possibly be set to permit gamers win every single time. However, administrators most likely be careful to be able to keep winning all the time because allow scare players away. Occasionally, gamers must win which will attract substantially players.

The final type of slot may be the bonus game. These were created to help add a part of fun in the slot machine process. Each and every winning combination is played, the slot machine will provide you with a short game of which may be unrelated SLOT CASINO for the slot workout machine. These short games normally require no additional bets, and help liven up the repetitive nature of slot machine game play around.

If you’re planning to play, it ideal to prepare yourself and know for sure how long you become playing make certain you can provide to yourself a spending budget. You should do not be willing to waste a lot of money through this. It is an efficient form of recreation which enable it to also earn for you some monetary. However, losing a fortune is never advisable.

If you hit between the equivalent amount of money to 49% profit, then it is play again with that same machine. Your odds of of having the jackpot are greatly high as it may be a “hot slot”. For example, if you started spinning for $100 may have about $100-$149 as profit, offer an indication that the slot you playing is a thing that provides each best agreed payment SLOT ONLINE .

Blackjack or 21 regarded as easiest casino games vehicle insurance and compete. The idea of the game is to a hand closer to 21 compared to dealer. When playing https://game03.mahabetx77.online/ , regardless which of how to versions you may well be playing, sport is between you and also the dealer regardless of what many players are from your table. Practice free, numerous versions of Blackjack and see the game you like best. If you have determined your game selected develop a technique you will utilize in the real money game. You could pocket some serious take advantage this game and this available in download and flash versions as well as Live Dealer Online casinos.

In a nutshell, the R4 / R4i is simply a card which enables in order to definitely run multimedia files or game files on your DS. No editing in the system files is required; it is strictly a ‘soft mod’ that has no effect on your NDS in in any manner. You just insert the R4i / R4 card into the GAME SLOT, along with the R4 / R4i software will run.

Experience the exciting sounds of the casino in your own home utilizing Crazy Diamonds machine save. This is a replica on the larger scale featuring the real-life sounds of the casino aided by the jackpot light that flashes and the benefit of a bank in order to your coinage. By the way, this video slot will take 98% of coins made the worldwide.

By trustworthy, it doesn’t only mean someone who won’t swindle your capital. Trustworthiness also means a company who thinks of the associated with their players. Do they offer multiple payment and withdrawal options? Will someone guide you straight or answer your questions if and as soon as you demand it? Are you really acquiring paid an individual are win?

…

Blackjack or 21 is one of the easiest casino games to learn and have fun playing. The idea of the game is a hand closer to 21 compared to a dealer. When playing MAHABET 77 , regardless which of different versions you may be playing, recreation is between you as well as the dealer does not matter how many players are on the table. Practice free, how to versions of Blackjack to get the game you like best. Demonstration determined your game of choice develop something you will utilize in a real money game. Can perform pocket some serious money in this game and it is available in download and flash versions as well as Live Dealer Online casinos.

This happens, and consuming know if you stop to prevent losing further and whenever you continue to obtain back what you have puzzled. Tracking the game is another wise move, as always be determine guard action. Preserving your cool despite that losing assists you think more clearly, thus an individual to generate more earnings.

GAME ONLINE SLOT Bonus Added Slots: Features include multi-spins, 5 reels, multi-lines, bonus games, wild symbols, scatter pay, multiplier and nudge-hold. Available at casinos and also land-based.

The R4 cards furthermore used for storing music files of different types. You can use these listen to songs after downloading and storing them in your device. Again, you may use the cards to be careful about your favorite movies after where you install them on your device. Moreover, you should use them to browse various websites in which you can download heaps of different files.

The player of this machine will first insert the token into the device. Then pull the lever or press the hotlink. The game is positioned in motion to rotate with specific picture regarding it. Whenever the player wins could be determined that pictures is line on the top of the pay line the particular middle on the viewing movie screen. Winning combinations vary according towards rules of the SLOT ONLINE particular game. Only then will the slot will payout the victor. The winning portion of a video slot is 82-92%.

First off, online slots offer all the fun and excitement of live slots but through the comfort of your own to your home. You don’t always be waste along with money travelling all approach to an out of town cyber casino. Actually the neatest thing about is actually a that you’re able to play whenever you want for as long as you want. That means you don’t in order to play provided you possess a 3 hour block unengaged to play.

Another factor about may be that lucrative many options available for the customer. Over the internet, a quantity of websites exist providing various slot games to its customers. If you’re are not interested in a service of 1 particular website, you can always search for an additional one in only a case of minutes. Playing online slot machine game is also beneficial because can fiddle with GAMING SLOT GACOR it if you want. As opposed to casinos, you will have to have to wait until your favorite machine comes and vacated by the last player.

Be associated with how many symbols take presctiption the slot machine game. When you sit down, the first thing you should notice is when many symbols are with the machine. Tinier businesses of symbols are directly proportional on the number of possible combinations you have to win.

…

First, set yourself to play. Be sure of having cash. They not receive vouchers in playing openings. Then, set an amount to spend for the day on that program. Once you consumed this amount, stop playing accessible back again next the time. Do not use the money inside one sitting and surroundings. Next, set your time alarm. Once it rings, stop playing and setting off from the casino. Another, tell you to ultimately abandon gear once shipped to you the slot tournament. Do not be so greedy thinking that you want more victories. However, if you still money within your roll bank, then could possibly still try other slot games. Yes, do not think that machine an individual had won is lucky to help you to be win again and again again. No, it will just deplete all income and these types of lose added.

First is the time. Most of us should use our time wisely. Using the casino or playing online casino games is a leisure working out. However, there are people who get hooked with it and explore their associated with time. Be CRYPTO BET77 make sure to. Before entering the casino or logging in on the internet casino games, set your hair a specific lifetime of play instance. Once your watch alarms a person that your is up, stop your work and proceed for. Do not put all your money at an increased risk or you may be bankrupted and go home with super nothing.

Quiz shows naturally trust online slots and specially the bonus game that tend to be a big member of the video slot experience. Two example of UK game shows which have been now video slots are Blankety Blank and Sale of the century. Sale of the Century features the authentic music out of your 70’s quiz and does really well in reflecting the slightly cheesy facets of the board game. Blankety Blank also has bonus rounds similar to your TV tell.

Atomic Age Slots for your High Roller – $75 Spin Slots: – This can be a SLOT GAME from Rival Gaming casinos and allows someone to wager just about 75 coins for each spin. The $1 may be the largest denomination in money. This slot focuses on the 1950’s era within the American pop culture. This is a video slot game which has the advanced sounds and graphics. The wild symbol in this game is the icon for the drive-in as well as the icon which lets shipped to you the most is the atom logo.

Quiz shows naturally effectively with online slots especially the bonus game have got a big part for the video slot experience. Two example of UK game shows which usually are now video slots are Blankety Blank and Sale of the century. Sale in the Century features the authentic music via the 70’s quiz and does really well in reflecting the slightly cheesy associated with the online application. Blankety Blank have bonus rounds similar on the TV tv series.

For others it is really a constant feeding of money into the machine that yields them nothing but heartbreak and frustration. It is a bet on chance that always favors residence. But if in order to wondering how slot machines work and think you are able to take them on, SLOT GAMING this information is for any person.

Before Childs was placed in the book, he already had a wonderful arrest record, he was arrested 45 times. Many these arrests came from gaming and others were grand larceny costs. Childs was convicted about 7 times for specifically slot machine game cheating. Childs is a veteran of doing what he is doing GAME SLOT best. The ironic part that is if you ask Childs if he thinks that have to another wrong in slot cheating the actual will decline.

It one more advisable which you set a win limit. the amount that will distinguish a great deal more are already satisfied on winning and able to to stop playing. Can be a many players who keep on playing just because they are experiencing a winning streak. Provide you . a big mistake. If you are winning, that in order to an indication to cash out and write. Otherwise, this may bring about your great loss. Casino wars are always tricky. At first, it really is going give you with a winning streak to lure you into placing big amounts of bets a person are believing that you are increasingly becoming lucky. Then, suddenly, determination big bet, you will miss taking away a quite a bit of your profits as well as your bankroll. Letting this happen is not smart to be able to do casinos.

…

Tip #1 The greatest is to ensure you have in mind the rules of blackjack. Is actually usually always a proficient idea to put together a strategy when you play roulette. All winning systems are made from a basic strategy which consists of statistically speaking, there exists only one best action a player can take for each among the possible hands he can receive versus each possible upcard the casino dealer may take.

With this exciting slot machine you will see several action game symbols as well as bonus features. You will find numerous web sites where could certainly play this procedure packed video slot. During online game you may possibly three progressive jackpots money-back guarantee will be awarded at random , GAME ONLINE SLOT . This machine has three bonus features available and a max 6000 coins payout per average spin per pay row.

3D Car Racing Game – many . one of your car games that a person a 3D first person perspective close to game, in comparison to most flash games which are presented in 2D birds eye see SLOT ONLINE . The game features beautiful 3D graphics that will allow your race interest using a maximum.

Well when you are a individual who basically desires to have fun and entirely contains luck, is definitely the to play in the game of Slot Machines, Bingo, Keno and Lotto. In here, no matter what others tells you, there is not any way to affect in relation to of online game. Although these are games of luck, players can continue to use a number of best regarding their strategy: they’re able to bet since many options you are able to.

It’s almost a dead giveaway here, except for the fact that the R4 DS comes in it’s own R4 DS Box. But you’ll understand that once you open the box, the contents with the box are similar to the M3 DS Simply, you even get must not light blue colored keychain / carry case that comes with the M3 DS simply. You receive everything you need, straight out of brother ql-570 comes with. This includes the R4 DS slot 1 cartridge, a USB microSD Reader / writer (and this actually allows for you to definitely use your microSD for a USB Drive) as well as the keychain carrying case and the application CD.

Each site that bingo is played on will contain different coin denominations. The amount might set at fifty cents or twenty cents GAMING SLOT GACOR approach to to be in the rounds and the spins might be five dollars each. These amounts could change with different sites and regulations. It may possibly be important to try out a few websites to view which is actually the easiest to take advantage of. All sites give information yet be used to help win the event. The more informed a player is, the more likely the player will play well and understand the are engaging in.

The amount you wish to pay depends on the associated with payout the equipment gives. Or even nickel machines and five dollar coffee makers. The choice of which type to play depends anyone. Of course, the bigger payout, the bigger fee. Completely free slot machine games play online, if at all possible not be charge a fee. These free slot machine game games are fashioned to familiarize the beginner or people who have not played any machine. This will enable the actual learn in respect to the combinations and also the payouts. Following GG 189 , you may already wager legitimate money. For all those who simply need to benefit from ipod excitement resulted by pai gow poker. They can just play for free anytime they want. With enormous number of free action online, they’ll never run out of solutions.

If most likely lucky enough to win on a video slot machine, leave that machine. Don’t think that machine may be the ‘lucky machine’ for you will. It made you win once about the will not let upon the next games for certain. Remember that pai gow poker are regulated by random number generator and this is electrically operated. In every second, it changes gasoline efficiency of symbols for a lot of times. And over of the time, the combinations are not in favor of anybody. If you still host the time or remaining balance in your allotted money, then maybe you can try the other slot technological equipment. Look for the slot machine game that offers high bonuses and high payouts but requiring fewer coins.

…

First, set yourself to play. Be particular to have currency. SITUS JUDI SLOT do not receive vouchers in playing slots. Then, set an amount to sow in that day on that game. An individual consumed this amount, stop playing and come back again next some time. Do not utilise all your profit just one sitting and setting. Next, set your own time alarm. Once it rings, stop playing and get out from the casino. Another, tell you to ultimately abandon device once you win the slot tournament. Don’t be so greedy convinced that you want more advantages. However, if you’ve have money in your roll bank, then may still try other slot games. Yes, do not think that machine in had won is that are fortunate enough to help you to be win over and over again. No, it will just exhaust all money and these lose more.

Some rewards are larger, such as complimentary trips to a buffet or even restaurant in the casino. In the event the place an individual might be playing at has a hotel, bulletins get a reduced room rate (or even free nights). For anybody who is a through the roof roller, you might get airfare or taxi to and from the casino.

In land based casinos there is really a service light or candle on top of the video slot. This can be activated together with player they will have a question, want a drink, need change or has a technical trouble. In order to activate the light the player should push the change button. You will set away from the light or candle and it will blink to permit SLOT ONLINE employee’s realize assistance ought to be needed. The light or candle will automatically blink if there a victorious one. A player should never walk away from a machine with a blinking light it could mean tend to be a victorious one. If you walk out from a blinking light machine you aren’t going to be able to claim the takings.

If you pass just a little money, even if it isn’t progressive jackpot, edit and view your prize money. An individual do canrrrt you create the money you have set by themselves for the day meet from wearing non-standard and try again in a day or regarding.

An addition to that, is an efficient GAME SLOT flashing jackpot light which adds extra pleasure. The most thrilling feature of the device is it topped up with chrome bring. Nevertheless, the thrill does not end at this website. The machine has an inbuilt doubled bank that is known for a saving section separately which accepts perhaps 98% all over the world coins.

For younger kids, Carrera cars are often used to teach basic mathematical concepts such as grouping, ordering, sorting, and patterning. Try matching vehicles based on the colors styles and sizes. The cars become kids learning toys as kids identify right after to sort them and group these businesses.

#5: SLOT CASINO Existence can improvement in a minute. See #4. The only way your life can change at a sport like Roulette is by using everything you own and bet it in a single spin of the roulette wheel. In slots you can be playing the way you normally play immediately after boom – suddenly you’ve just won $200k.

At these casinos they will either allow you to enter a mode, or give you bonus revolves. In the free mode they hand you some free casino credits, which haven’t cash increased value. What this allows you to do is within the various games that have the information site. Once you have played a online slot machine that you favor the most you will be comfortable by using it once the ease in starts to play for day-to-day money.

…

No, you don’t a permit to purchase one. These are novelty machines, not the huge slots you play in Las Las vegas, nevada. They do pay out jackpots, but only the spare change an individual inside discharges out. Casinos use tokens to control payouts folks that need to break in the individual. The tokens themselves have no value at all once beyond your building. Anyone dumb enough to cash them in will acquire a free ride from nearby police.

Slot machine gaming is a sort of gambling, where money is normally the basic unit. You may make it grow, or watch it fade GAME SLOT from your hands. Always be bother much if small amounts of money are involved. However, playing the slots wouldn’t work in only have minimal gamble.

In a progressive SLOT GAME, a small portion with the money used on each spin is placed on a jackpot fund. So, each time someone gets a spin using the machine, the jackpot evolves. And it continues to grow until someone hits the big win.

In JURAGAN 4D of the games in Mount Everest schedule Let me expect option 1 to get chosen in your house against Seville and Villarreal and option 2 in order to become chosen away at Valencia, due to Henry always playing well against Valencia.

SLOT GAMING Payback represents what area of every dollar taken in by the slot pays back away. The other side of the payback percentage represents the home edge.

To win, you are necessary to match reels’ in conjunction with pay credit lines. Therefore, the likelihood of winning end up being better when the number of pay lines is more, but the pay out at multiline games is less compared to single line games.

In 1979, gambling was passed in New Jersey, and Atlantic City took over as Las Vegas of the east seacoast. In the mid to late eighties, video style poker games were developed and obsession with slots were becoming a bit more invasive.

…

If you are playing a progressive slot and your bankroll is too short perform max coins, move down a coin size. As an alternative to playing the dollar progressive games, use the quarter progressive games. It will can play max coins, you can land the jackpot on that title.

Using PRIMA BET78 allows the user to send and receive either a simple text message or multimedia message with sounds and photos. Because it also has email service, users would likewise be able to send and receive emails acording to this handset.

A video slot “Operator Bell” similar to “Liberty Bell” in design was created in 1907, by Herbert Mills. He was a Chicago brand. This slot machine had experienced a greater success. In 1910 slot machines became very common throughout SLOT GAMING America.

Once you have chosen the regarding SLOT GAME you are comfortable with, the next thing is to take a machine that you think have the highest chance of letting won by you. Here is the key tip: It’s not as much the involving game you decide. To choose a winning machine, you spend more awareness of how administrators manage the machines.

During the game, players place money on layout, design and call chips. The car dealer hands players special roulette chips that cannot be used anywhere other than you are on the list. After the game, the player to be able to exchange the chips for regular casino chips, if he wishes to use them elsewhere typically the casino. The chips also have a denomination could be handed over based on players’ requires. Every single player receives chips for the different color enabling the card dealer to keep track of which player the chips belong on.

If three or more symbols appear from left to right you get what referred to as a Spiderman feature. When this feature is triggered the player can GAME SLOT select from two features called free spins or venom.

Quiz shows naturally work nicely with online slots especially the bonus game get been a big part of the video slot experience. Two example of UK game shows that are now video slots are Blankety Blank and Sale of a lifetime. Sale on the Century features the authentic music belonging to the 70’s quiz and does really well in reflecting the slightly cheesy associated with the on the internet game. Blankety Blank gives bonus rounds similar for the TV show.

…

You can get to pay as low as $20 bucks, but bigger replica banks will run about $80. Each the a bit different among the others, however made to undertake the same thing: maintain your change and take money away from your friends. You have to treat them like arcade games inside your home.

Players everywhere over the world will appreciate every one of the awesome features that 3Dice offers their players, out from the chat room, to the daily free tournaments for any of players. Is identical stop there because as you play SLOT CASINO you will get rewarded with loyalty and benefits dependant on your VIP status.

Bingo-The bingo room includes capacity of accommodating 3,600 people. The standard bingo game is scheduled twice day after day. Apart from the regular game some major money games like Money Machine, Money Wheel, Cars, Crazy L, and Crazy T etc can also be played. It’s got non- smoking sections where people with kids can play too.

Do not use your prize perform. To avoid this, have your prize down. Casinos require cash in component in. With check, you can get away from SLOT ONLINE temptation of employing your prize up.

To verify 172.232.238.121 of cherry machine you are dealing with you need to follow these pointers. Sit back view the screens the game goes through while it is not being played. Determine the company that would make the machine. Once the game screen flashes perform see historical past of the in the upper left local. It is either a “Dyna” perhaps a “Game”. GAME SLOT Of the two separate company’s come up with most just about all cherry entrepreneurs.

Another thing to shop for when choosing mobile casinos for slots is when offer flexible betting banks. You should be able to play both high and minimal stakes and not just one assaulted other. Need to also have an understanding of the winning lines, betting tiers and pay chart.

Others feel that if a device has just paid out a fairly large payout that it won’t payout again for a short time. Who knows whether any of your strategies do work. Factor for certain is if there is any strong indication may do, the manufacturers will soon do these details is all can adjust that.

…

It’s almost a dead giveaway here, except for your fact how the R4 DS comes in it’s own R4 DS Box. But you’ll realize that once you open the box, the contents of your box are indifferent to the M3 DS Simply, you will get replacing light blue colored keychain / carry case which comes with the M3 DS simply. An individual everything you need, out of the box. This includes the R4 DS slot 1 cartridge, a USB microSD Reader / writer (and this actually allows of which you use your microSD for a USB Drive) as well as the keychain travel case and the software CD.

To help out with keeping the cars in this device have added traction magnets to the auto to exert downward force thereby allowing cars to help keep on the track at faster data. This also allows folks to make vertical climbs and perform a loop the loop.

An addition to that, it features a flashing jackpot light which adds a supplementary pleasure. One of the most thrilling feature of handy is it topped with chrome prune. Nevertheless, the thrill does not end ideal here. The machine has an inbuilt doubled bank that rrs known for a saving section separately which accepts anyway SLOT ONLINE 98% on the planet coins.

Once you’ve selected the connected with slot game you are comfy with, an additional step is to a machine that you think have superior chance of letting you win SLOT CASINO . Here is the key tip: It is not so much the type of game you ultimately choose. To choose a winning machine, you need to pay more attention to how administrators manage the machines.

Once clicking the button for the bonus, an additional benefit wheel possibly pop up on your present. You will notice that it says Loot and RP. The RP would mean Reward Zones. This means that when you spin the wheel, you may land on special bonus loot a person may get some reward points as special bonus.

Another consideration is the payout in the machine. A good rule of thumb happens when GAME SLOT a machine has a high payout you will win less smaller payouts. A device that encompasses a lower payout will hit more often but you might not get that million dollar jackpot. In line with whether you want to play frequent on a financial budget or wish to “go for broke” in order to hit large one, look at the maximum payout of device. If the jackpot is only 500 times the coin value or less the washer will pay smaller amounts more often and keep you playing on a relatively small budget.

Black king pulsar skill stop machine is one of several slot machines, which is widely also great for the people of different ages. This slot machine was also refurbished ultimately factory. This had thoroughly tested in the factory and thereafter it was sent to various stores available.

The second option they may offer you is the chance to play at no cost for 1 hour. They will give merely specific involving bonus credits to use. If you lose them in hour then this trial is now finished. If you end up winning within hour you just might like be effective in keeping your winnings but a number of very specific restrictions. KRATONBET will need to read the rules and regulations cautiously regarding this specific. Each casino has its own set of rules generally speaking.

…

The R4 and R4i cards include wonderful features that can enhance your gaming platform. Both cards enhance use of devices if you make regarding them for starters thing insect killer other. They have the capability of storing all types of game files including videos and music files. Will be able to slot inside the cards with your game console and use them to download games files online. They also include features for transferring files and documents from one console on the other.

With the cards, you may enjoy playing all styles of games. You should use them to play video games in this kind of fantastic manner. With them, you can download games files directly as well as also store them when you SLOT ONLINE you wish. You’re sure of enjoying playing your favorite games then you can certainly the cards well slotted in your console.

However, if you’re do that, then you’ll need to wager around $1000 on slot machines before are able to meet the casino requirements to develop a withdrawal. So say you won $2000 playing online roulette, you now have a buffer close to $1,000 to create sure even if you’re lost $1000 on slot machines, you made $1000 profit. Of course, slot machine game winnings likewise add for the profits, in which means you might make more then $1000.

The online casino software package is easy to use. In many cases it is in fact easier than playing near a land based casino. Your chips are counted a person personally and shown on screen and you are given a listing of betting varieties. It may sound like small things, but craps is a fast paced game in a casino and many times, it becomes confusing. The casino is actually trying to confuse that you. Have you ever realized that there work just like clocks or windows within a casino?

To be a master of poker these items need generations. In this case, again choosing a football analogy seeing not simply watch your favourite team play, but become its full member and receives a commission for the site GAME ONLINE SLOT .

If you play Rainbow Riches, it’s help spot the crystal clear graphics as well as the cool sounds. Jingling coins and leprechauns and rainbows and pots of gold are acceptable rendered. Pai gow poker have really developed since greatest idea . of the hand-pulled lever operated mechanical machines. The theme is Irish with Leprechauns and pots of gold and won’t look incongruous on an internet casino slot contraption. You can play Rainbow Riches on several spin-offs of the machine as well, most notably Win Big Shindig with regard to. And skip over what? Rainbow Riches has an online version too! It feels and looks exactly this kind of real thing and irrespective of how absolutely no difference. Be interested to get there be any large difference GAMING SLOT GACOR ? Both online and offline are computer controlled machines that use the same software.

Slots are positioned up to encourage players to play more gold coins. 172.232.249.118 is clear to have a look at more coins one bets, the better the odds and the payouts have been. Most machines allow you to pick the associated with the coin that you will play and. When the payout schedule pays at better pay for more coins, are usually better off playing smaller denominations and maximum gold coins. This concept seems simple, but a majority jackpots been recently lost by careless play around.

The RNG generates range for each spin. Numerous corresponds into the symbols round the Reel. There are hundreds of Virtual stops on each reel although you see far fewer symbols. Observe the to generate millions of combinations could be the reason that online slot machine games can offer such large payouts, currently being the chances of hitting jackpots are exceptional. You may see 15 reels and calculate the odds as 15 x 15 x 15 1:3,375. However, what do not have to see will be virtual stops, and can be a 100 or more per fishing reel! At 100 per reel, end up being be 100 x 100 x 100, or probabilities of 1:1,000,000. Retard how they finance those million pound payouts? Congratulations, you know!

…

As a slot player, you should also know must change machines so which you can effectively increase your winnings. May always best to change machines if current machine produces you to get rid of a number of times. By means of happens, undertake it ! move to the adjacent slot machines. It is typical for casinos to arrange two good slots almost each other kinds of. Observing the performance of handy is essential for each slot machine player. Within duration of the games, activity . noticed an individual have used a “cold slot”, it takes a high possibility that the machine definitely it is a “hot slot”.

REPUBLIK365 of slot may be the bonus poker game. These were created to help add some fun into the slot machine process. When a winning combination is played, the slot machine game will give you a short game escalating unrelated to your slot washing machine. These short games normally require no additional bets, and help liven up the repetitive nature of slot machine game play around.

Free winning casino strategy #3 – Most of the table games are worth playing the particular slot toys. One in particular that sticks out is none other then poker. In can find some winning methods on poker and focus the game inside and out there’s always something good make funds from the casino players naturally.

Their tournament lobby is always jumping with action. 24/7 there can be a tournament materializing for all players. Every hour, VIP players are provided a freeroll tournament to enter, this goes on around the hands of time. Special event tournaments and more are grounds for GAME SLOT additional tourneys.

SLOT CASINO The best slot machines to win are often times located near the winning claims booth. This is the casinos would desire to attract more players who’ll see earlier onset arthritis . lining up in the claims booth cheering and talking relating to winnings.

To avoid losing big amount money at slots, you should set a spending budget for yourself before mastering. Once you have exhausted your plan for a session, you should leave the slot and move on to. There is no point in losing endless money in a hope november 23. In case you win, you should not use your winning credits to play more. Simply because the chances of winning and losing are equal in slot machines, you can never be absolute to win more. Therefore, you can be happy in doing you have won.

This article summarizes 10 popular online slot machines, including For the SLOT ONLINE Reels Turn, Cleopatra’s Gold, Enchanted Garden, Ladies Nite, Pay Land!, Princess Jewels, Red White and Win, The Reel Deal, Tomb Raider, and Thunderstruck.

In a gambling scenario, it’s everything about odds. No machine always be set to permit gamers win every single time. However, administrators need to be careful to be able to keep winning all period because is going to also scare players away. Occasionally, gamers must win and that will attract significantly players.

…

Another thing to search out when choosing mobile casinos for slots is that they offer flexible betting amounts. You should be able to play both high and minimal stakes and not merely one or the other. Should also fully understand the winning lines, betting tiers and pay room table.

In land based casinos there is a service light or candle on the surface of the video slot. This can be activated in the player whenever they have a question, will need drink, need change or has a technical rrssue. In order to activate the light the player should push the change button. Higher set there are various light or candle visualize new and different will blink to permit the employee’s be assured that assistance it takes. The light or candle will automatically blink if there a receiver. A player should never walk quitting a machine with a blinking light it could mean an individual a victorious. If you walk from the a blinking light machine you is definitely not able declare the profits.

3) Incredible Spiderman – this GAME SLOT yet another one with the video video poker machines that helps to make the most from the film tie in. It has three features and End up toning provide some seriously big wins as a result of Marvel Hero Jackpot.

At these casinos they will either allow you to enter a no cost mode, or give you bonus rotates. In the free mode they offer you a some free casino credits, which don’t have any cash value. What this allows you to do is have fun with the various games that use the information site. Once you have played a online slot machine that you favor the most you can comfortable using it once SLOT CASINO the ease in starts to play for hard cash.

Upon understanding that the machine is a first-rate slot, do not place big bets yet. You need to start bankroll test first. Locations tips you simply should consider when making a bankroll tested. If the machine is giving over 50% or more profit, then leave that machine and forestall playing energy. Chances are, the spin will cost you an oversized loss. You have anything near comparable thing amount to 49% of your money and profits, could certainly stay and play with this machine again. That machine is potentially a good machine any user let you hit a significant jackpot today.

Second, you’ll need to choose a way to advance your account and withdraw your earnings. Each online casino offers multiple solutions to accomplish this, so review everything very carefully, and select the option you think is best for your condition. The great thing that SLOT ONLINE step their process, often that the payment option you select, will almost assuredly work for good other online casino running, exercising to enroll with.

It Stays real cash flow. Don’t forget that although your chips are just numbers on a screen, it is still REAL finances. AGS9 may sound a little silly, but sometimes people forget that what is how they end up losing lots of money.

…

Tip #3 As you advance being a player, learn how to bluff. Is not actually working the game well and bluff when you feel secure that the other players will not call your bluff.

If you want to try out gambling without risking too much, have you thought to try GAMING SLOT GACOR going to some for the older casinos that offer some free games in their slot machines just a person could test playing in their establishments. Suggested ask you to fill up some information sheets, but that is it. You’re able play inside slot machines for absolutely free!

Once this where you are going to host your party you’ll need will must have to set to start dating and spare time. If you made their minds up to be concerned in a vendor show, then they will set the date. These be permitted to pick your time slot.

Slot machine gaming is a type of gambling, where money is certainly the basic unit. You may make it grow, or watch it fade out of your hands. End up being bother much if small amounts of money are involved. However, playing the slots wouldn’t work SLOT ONLINE a person are only have minimal choices.

Scatter symbols can also be used to substitute pictures and two or more could earn a player free re-writes. If three to scatter symbols are used then to a maximum of fifteen free spins are awarded.

When the gambling was banned, kind of the slots was progressed. The sums belonging to the prizes were replaced with the pictures for the chewing gum packages, as well as tastes were depicted for a respective GAME ONLINE SLOT fruit. The amounts of jackpot have also been increasing inside addition to the availability of the fitness machines. In https://site04.angkasa189.com/ grow jackpots additional reels were built into the machines. The slots got larger along with internal design was constantly changing.

Tip #1 Just along with many other poker, need to know sport of electronic poker. There is a diverse variant of video poker games, with every having alternate choice . set of winning card combinations. Occasion a choice to notice to even though a machine uses one 52-deck of cards a lot more than anyone. The more cards there are, the less likely the player will success.

…

The Lord of the Rings Slot machine is a Pachislo Slot Machine, which means that you will be that can control as soon as the reels will stop spinning during your turn. Treatments for acne you to infuse the same slot machine experience having a bit more skill! The slot machine also carries a mini game that is available for for you to definitely play between spins.

One thing to remember is this doesn’t possess a pull lever on along side it. It’s a more up dating version of how slot machines are played today. Of course there handful of of you who use the old classic versions, but we that fit this description one much more. On the game you’ll find 7s, bells, cars with flames the actual back, wilds, watermelons, properly course cherries. Definitely enough to a person busy for quite SLOT ONLINE a long time ago.

Make sure you play maximum coins when imperative. DINA189 pay on specific wins on the first coin, other types on surplus and every winning combination on the third, regarding Blazing 7’s. On machines that have several lines, play all the lines.

Get realize your recognize the game on a machine, this is very very important to the fresh players. Players who are online possibly in land casinos should preserve in mind that they get amply trained with recreation that considerable playing on the machines. Preserving the earth . every player’s dream SLOT CASINO to win on a slot unit.

Online Slot machines have been a good alternative for people today just use the internet to the game. Lots of things come and go with the intention with the slot machine as although technology gets better.

Once we’re everyone setup with French fries the game commences and also it usually takes about couple of hours for someone to be victorious. In the meantime, we possess a waitress who comes by and gets these Poker Players drinks, whether it be possible water, soda, or adult beverages with the bar. Yes, just prefer casinos precisely how we all look in internet is if we’re in order to be lose money, we might lose it to each other instead associated with an casino.